Bao Viet Group (BVH)’s financial report for the second quarter said that this unit owned a portfolio of trading securities with original cost at the end of June amounting to more than VND 2,954 billion, although a decrease compared to the end of the second quarter, but still increased by 3.9% compared to the beginning of the year and accounted for about 1.5% of total assets.

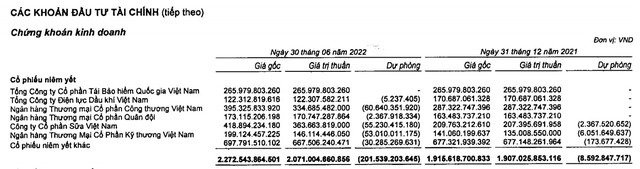

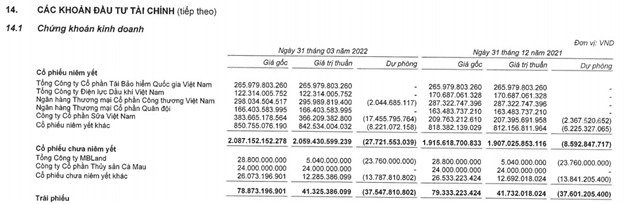

In which, listed shares are the largest component (accounting for nearly 77%) with the original price of nearly 2,273 billion VND, an increase of 357 billion VND compared to the end of 2021 and 186 billion VND increase compared to the end of March. The trading stock portfolio of this group is CTG, MBB, TCB, VNM, POW, VNR.

In the second quarter, Baoviet Group bought more than 97 billion dong of CTG shares of VietinBank; bringing the total original value of ownership to 395.3 billion dong. As for VietinBank shares, BVH made provision for a loss of 60.6 billion dong as of June 30, much higher than the provision of more than 2 billion dong at the end of the first quarter.

This group also bought a large amount of Techcombank shares, making this stock one of the largest listed stock investments with the original price of more than 199 billion dong. Previously, the number of TCB shares owned by Bao Viet at the end of 2021 was at VND 141 billion and was not mentioned in the list of stocks held the most at the end of the first quarter.

In the banking group, BVH also bought another 6.4 billion dong of MBB shares; raising the original value of holding to more than 173 billion dong and provisioning 2.4 billion dong for this investment.

Regarding stock price movements, both CTG, TCB and MBB plummeted in the second quarter and lost about 30% of their value. This may be the driving factor for BVH to “fish at the bottom” of this group of stocks.

Along with banking stocks, BVH increased VNM holdings from 383.7 billion dong to 418.9 billion dong. This is also the largest investment in the group’s trading securities portfolio.

BVH’s investment portfolio also includes VNR shares of National Reinsurance Corporation and POW of PetroVietnam Power Corporation at the original price unchanged from the end of 2021, respectively at nearly 266 billion VND and more than 122 billion VND.

Besides high value stocks, BVH’s portfolio has nearly 698 billion dong of other listed shares and nearly 79 billion dong of unlisted shares. In addition, this group also invests hundreds of billions in bank bonds, government bonds and fund certificates.

Baoviet Holdings’ securities investment activities are strongly supported by its strong financial potential with cash and deposits of up to hundreds of trillions of dong.

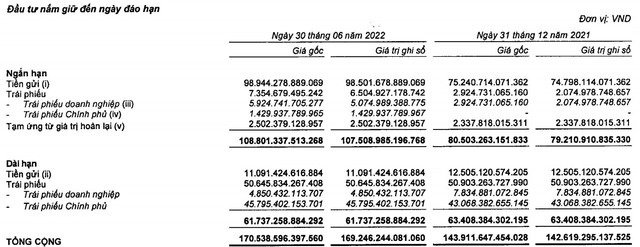

According to the financial report of the second quarter, the cash amount of BVH as of June 30 is more than VND 870 billion. At the same time, this business also owns nearly 110,000 billion VND in bank deposits, an increase of more than 25% compared to the end of 2021.

Due to the nature of their business, insurance businesses are among the largest owners of financial portfolios in the economy. Therefore, recent fluctuations in the stock market and interest rates are having a direct impact on the business results of this industry.

With the decline of the stock market as well as the low interest rate, BVH’s profit from financial activities in the first half of the year decreased by 3% year-on-year to VND3,886 billion despite the portfolio size increased quite strongly. This is the main reason why consolidated profit after tax decreased by 15% to nearly 828 billion dong.

BVH’s total assets at the end of the second quarter reached more than VND 193,291 billion, up 14% compared to the beginning of the year. In which, cash and cash equivalents decreased by 41% compared to the beginning of the year, to more than 3,138 billion VND. Short-term financial investment increased by 34%, reaching nearly VND 110,219 billion; while the long-term decrease by 3% to nearly 65,545 billion dong.